Introduction

Why Start a Business in Romania?

Romania is an attractive destination for business due to its:

- Fast incorporation: SRLs can be registered in as little as 5 working days.

- Minimal capital: There is no minimum capital requirement; an SRL can be formed with as little as RON 1.

- Full foreign ownership: Foreigners can fully own and control an SRL, with no need for a local partner.

- Favorable tax system – see full 2025 tax changes here:

- Microenterprise tax: 1% of revenue (if at least one employee) or 3% for certain CAEN codes (e.g., IT and food services).

- Profit tax: 16%, applicable if microenterprise conditions aren’t met.

- Dividends: Taxed at 10% (increased from 8% as of 2025). EU parent companies may qualify for 0%.

- Microenterprise threshold: Reduced to €250,000 in 2025, €100,000 from 2026.

- No consultancy income cap for microenterprise eligibility.

- EU benefits: Full EU access, VAT registration, and trade in EUR.

- Low costs: Affordable workforce, office space, and services.

- Modernized laws: Simplified red tape, digital filing, and startup support.

Table of Content

- Step 2 – Register Your Company Name & Check Availability

- Step 3 – Prepare the Necessary Documents

- Step 4 – Submit Company Registration at the Trade Register

- Step 5 – Get Your VAT and Tax Registration

- Step 6 – Open a Corporate Bank Account

- Step 7 – Obtain a Virtual or Physical Office

- Final Checklist – Your Romanian Company is Ready!

- Contact

Step 1 – Choose the Right Legal Structure

An SRL (limited liability company) is the most popular structure for foreign entrepreneurs due to:

- Limited liability protection.

- Can have 1–50 shareholders and one administrator.

- Full foreign ownership permitted.

- Capital can be RON 1 (roughly €0.20).

- Simple governance and tax benefits.

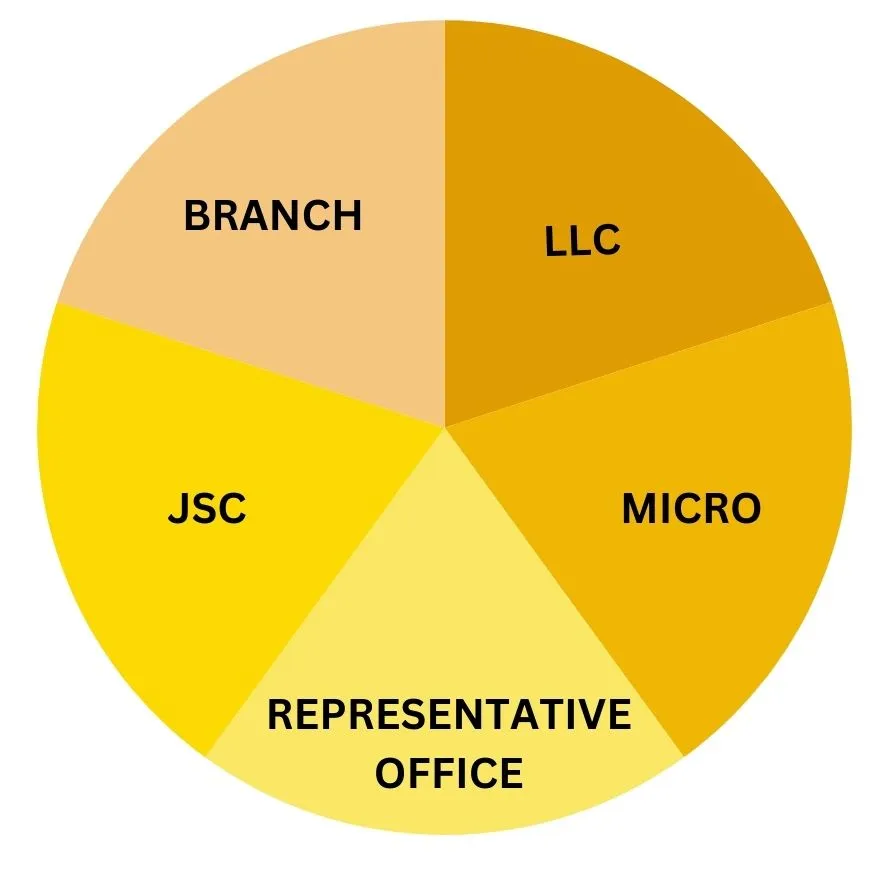

Other options include:

- SA (joint-stock company): Suitable for large ventures; requires RON 90,000 capital.

- PFA (freelancer): Requires Romanian residency; not ideal for foreigners.

Other options include different legal forms of business in Romania, such as SA (joint-stock), PFA (freelancer), or branch/subsidiary.

Decide your main CAEN activity code and any secondaries; check updated CAEN codes (Rev.3) here – needed for your Articles of Association.

Step 2 – Register Your Company Name & Check Availability

- Use the ONRC website to check availability and reserve a unique name with the “SRL” suffix.

- You can apply online or in person; online reservations are free.

- ONRC issues a Certificate of Name Reservation, valid for 30 days.

- Use this exact name in all incorporation documents.

Step 3 – Prepare the Necessary Documents

-

Compile and prepare the following for the Trade Register (full list with needed documents to start a business in Romania here):

- Application for registration and tax annex (provided by ONRC).

- Declaration of compliance (no special permits required or will be obtained).

- Name reservation certificate.

- Articles of Association (Act Constitutiv) in Romanian.

- Proof of registered office: Property title, lease, or virtual office contract.

- ID copies of founders and administrators (certified true copies).

- Affidavit for foreign shareholders (if no Romanian tax ID).

- Beneficial Owner Declaration.

- Taxe for Official Gazette publication (~RON 135).

Optional documents:

- Notarized translations of foreign documents.

- Apostille/legalization if signed abroad.

- Special permits if in a regulated industry.

All documents must be submitted in Romanian or bilingual. Using a lawyer or incorporation agent is highly recommended.

Step 4 – Submit Company Registration at the Trade Register

-

- File in person at the ONRC or online using an electronic signature.

- Include all required documents and proof of fee payment.

- Approval usually takes 5-7 working days.

You will receive:

- Certificate of Incorporation (with CUI number).

- Certificat Constatator.

- Registration decision.

No separate ANAF registration is needed—the CUI is also the company tax ID.

Step 5 – Get Your VAT and Tax Registration

- Corporate tax registration is automatic upon incorporation.

- VAT registration is optional unless revenue exceeds RON 300,000/year.

- Apply voluntarily at incorporation or later.

- Mandatory if you expect EU trade or exceed threshold.

- VAT rate: 19%; intra-EU services require a VAT ID.

- New 2025 rules:

- Dividend tax is now 10%.

- Microenterprise regime threshold: €250,000 revenue max.

- Consultancy income limits removed.

- 3% tax rate applies to certain IT and food-related CAEN codes.

- Other taxes:

- EORI (for non-EU trade).

- Payroll taxes if hiring.

Step 6 – Open a Corporate Bank Account

- Required to operate and receive capital.

- Most banks require:

- Certificate of incorporation.

- Articles of Association.

- Administrator’s passport.

- Proof of address (personal or company).

- Choose a bank with English support and online banking.

- Physical presence or power of attorney is required.

- You can open multiple currency accounts (RON, EUR, USD).

Step 7 – Obtain a Virtual or Physical Office

- The registered office can be:

- A physical office.

- A virtual office (common for foreign founders).

- Ensure:

- You have a valid contract.

- The address is properly registered.

- You maintain access to mail and government notifications.

- If you later rent a new space, update ONRC with the change.

Final Checklist – Your Romanian Company is Ready!

- ✅ Incorporation complete: Keep your certificates and certified copies.

- ✅ Fiscal registration: Confirm CUI and VAT status.

- ✅ Bank account open: Deposit capital and enable online access.

- ✅ Accounting setup: Hire a local accountant for keeping the company book accounts and submitting all the financal and tax statements, monthly/quarterly/yearly, as requested.

- ✅ Digital signature: Useful for online filings.

- ✅ Licenses: Check if your CAEN requires post-incorporation permits.

- ✅ Hiring: Register labor contracts with REVISAL and give power of attorney in front of ANAF for enrolment trough SPV; budget for salary taxes.

- ✅ Ongoing compliance:

- Submit annual financial statements by May 30.

- Update beneficial owner info if changes occur.

- Notify ONRC of any company data updates.

With these steps done, you can focus on building your business. Romania offers strong potential for startups and foreign-owned companies. Mult succes!

If you want us to help with starting your company in Romania, please contact us below.

Contact Us

Contact us using the provided contact form or via

email address: office@vulpoisiasociati.ro

Fields marked with * are mandatory!